A telematic commodity exchange could provide in Italy the transparency and fairness in the value chain that many people conjure up in words but no one really seems to want, in the agrifood supply chain. Some food for thought.

Context. Power imbalances in the agribusiness supply chain

Representations in Brussels of the various production sectors had worked hard since the beginning of the new Millennium to mitigate power imbalances within the agribusiness supply chain. The European Commission-as a result of repeated petitions, reminders and consultations of the parties-had thus proposed to strengthen the positions of farmers and processors on the three fronts of:

– Unfair commercial practices, then in fact regulated through EU Directive 2019/633, (1,2)

– Producer organizations (POs) and interbranch organizations to be promoted and supported,

– Transparency in the value chain, from farm to fork. (3)

Transparency and fairness in the value chain, EU goals

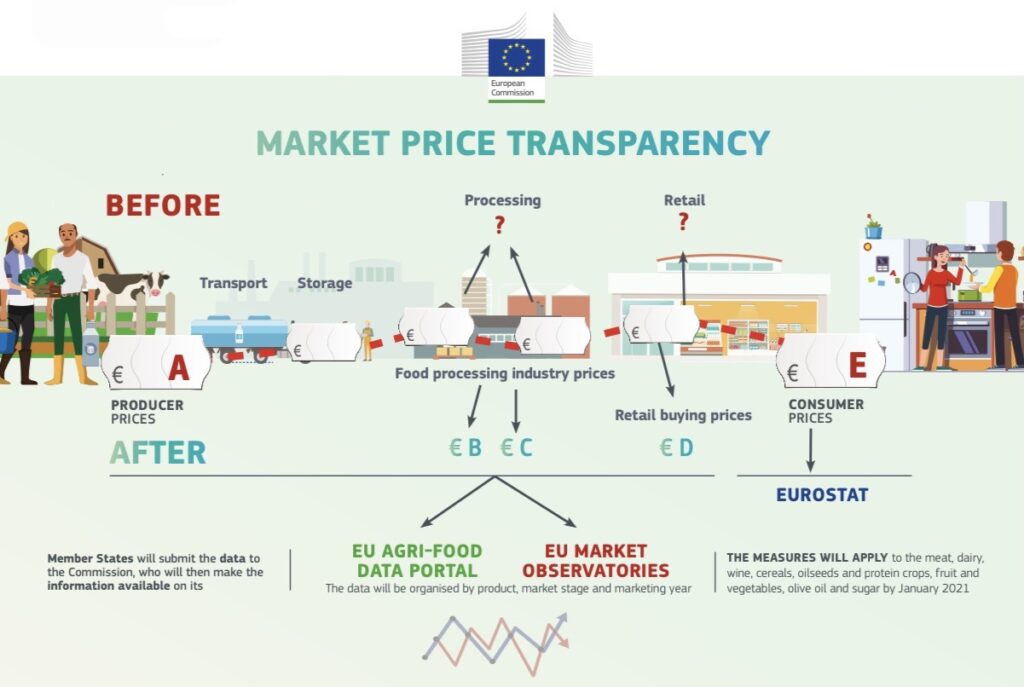

Lack of transparency in markets and information asymmetry cause inefficiency in markets themselves and disproportionate power in favor of those with access to the most accurate data. Therefore, the European Union has introduced a market information system related to a range of agricultural products.

‘Increasing market transparency means providing more information, on more products, more often. By doing so, we will give greater balance to the chain and ensure more efficient decision making. Transparency is also a matter of equity: we are enabling equitable access to price information that will bring greater clarity to how the food supply chain works’ (Phil Hogan, former Commissioner of Agriculture and Rural Development, 11.7.19). (4)

Information on agricultural prices is lacking, particularly in the intermediate stages of the food chain. And access to up-to-date data on market trends is crucial, particularly to SMEs and microenterprises that do not have other sources of information. Therefore, the European Commission has proposed new regulatory measures, to improve transparency in the agrifood market (5,6).

Transparency in markets, the EU system

The European system provides information on the EU agri-food data portal and market observatories, related to:

– Meat of the various species,

– eggs,

– dairy sector,

– fruit and vegetables,

– cereals and arable crops,

– sugars and molasses,

– olive oils.

EU member states are responsible for entering accurate and timely information into the system. But they may continue to use ‘existing systems and procedures for data collection,’ choose ‘the most cost-effective approach,’ and even ‘not target small and medium-sized enterprises.’ The Commission in each case collects only data on member states and commodities that express, in relation to individual production, at least 2 percent of the EU total (production or consumption). Data collection can also be coordinated by non-public bodies such as chambers of commerce, producer organizations or other business associations, provided that they ensure:

– Transparency in data collection organization and procedures,

– Continuity of data sets and methodological consistency,

– Compliance with competition rules, including those established in the Single CMO (EU reg. 1308/2013). (7)

EU system, opaque transparency

The industrial lobbies obviously prevailed over the agricultural lobbies in Brussels when defining the system, which therefore is worth getting a rough idea about international market trends but does not offer the data needed by operators. The shortcomings of the EU system are macroscopic:

– few categories of agri-food products, very few sub-categories expressing their different values. In antithesis to 40-year policies to promote quality (geographical indications, organic) in Europe. Thus PDO and PGI certified products have consumer prices double those of their equivalents, on average, but the raw materials used to produce them are equally remunerated, with rare exceptions, (8)

– exclusion of SMEs from data collection means not considering the majority share of agri-food supply in the EU. It is SMEs, moreover, that have the greatest need for data,

– the extreme flexibility accorded to member states results in the acquisition of data that are often unreliable, as demonstrated by the case of CUN pigs in Italy where quotations are systematically altered. (9)

Italy, telematic commodity exchange

Italy-in boasting the leadership Europe in value added in agriculture (ranked 2nd in sector turnover, after France), the global leader in registered geographical indications, and the third in the EU in food industry turnover (after Germany and France)-distinguishes itself from every other country in the Old Continent by the extreme fragmentation of the production chain. A telematic commodity exchange could collect data on a plurality of product categories on a single website under the systematic supervision of the Antitrust Authority (AGCM) to avoid the recurrence of fraudulent disruptions or otherwise unreliable data. (9). Therefore, reference clusters (subcategories) should be defined in relation to each product category to harmonize and update the minimum-maximum, exworks (EXW) quotations.

A structured market with telematic quotations-assisted by ‘digital notary’, i.e., the public blockchain that FAO itself recommends to restore balance in agrifood supply chains (10)-could provide authentic data, for example, on:

– collected volumes,

– sales,

– escorts,

– cultivated plots,

– accretion trends

– crop forecasts,

– quotations,

– futures.

Telematics market and value chain transparency

A national telematics marketplace – where the costs ‘from seed to fork‘ e ‘from feed to fork’ be clearly defined-could encourage the disappearance of those pockets of inefficiency and the parasites that continue to drain resources on a pulverized and volatile market, exposed to the daily moods of the weather and wholesalers. It will thus be possible to give certainty of sustainability to the farmer, the producer and the distributor, in order to offer Italian products to the consumer at fair and calmed costs in the long run. The appropriate structure of the Italian telematic commodity exchange will therefore be able to offer:

– a chance to define production and commercial lines that can revitalize supply in a traditionally static (an understatement) sector,

– comparison with quotations from other producing countries,

– the real measure of the real costs and values of Made in Italy agribusiness.

Dario Dongo

Notes

(1) Dario Dongo. Unfair trade practices, the EU directive 2019/633. GIFT(Great Italian Food Trade). 4.5.18, https://www.greatitalianfoodtrade.it/mercati/pratiche-commerciali-sleali-la-direttiva-ue-2019-633

(2) Dario Dongo. Unfair trade practices, double-down supply chain agreement. GIFT (Great Italian Food Trade). 7.3.21, https://www.greatitalianfoodtrade.it/idee/pratiche-commerciali-sleali-accordo-di-filiera-al-doppio-ribasso

(3) Dario Dongo. Transparency in the value chain, work in progress. GIFT (Great Italian Food Trade). 3/22/19, https://www.greatitalianfoodtrade.it/mercati/trasparenza-nella-catena-del-valore-lavori-in-corso

(4) European Commission, Agriculture and Rural Development. Fairness in the Food Supply Chain: Commission welcomes Member States’ support for greater price transparency. 11.9.19, https://ec.europa.eu/info/news/fairness-food-supply-chain-commission-welcomes-member-states-support-greater-price-transparency-2019-sep-11-0_en

(5) Reg. EU 2019/1746 Amending Regulation (EU) No. 2017/1185 laying down detailed rules for the implementation of Regulations (EU) No. 1307/2013 and (EU) no. 1308/2013 of the European Parliament and of the Council regarding notifications to the Commission of information and documents, https://eur-lex.europa.eu/eli/reg_impl/2019/1746/oj

(6) European Commission. Working paper ‘Market transparency in the EU’s food supply chain‘, accompanying reg. UE 2019/1746 [SWD/2019/0360 final]. https://eur-lex.europa.eu/legal-content/IT/TXT/?uri=CELEX%3A52019SC0360

(7) European Commission, Q&A. Improving market transparency in the agricultural and food supply chain. 29.11.19, https://ec.europa.eu/info/sites/info/files/food-farming-fisheries/key_policies/documents/market-transparency-faqs_en.pdf

(8) Dario Dongo. Geographical indications, 75 billion euros in EU. The missing database and safeguards. 21.2.21, https://www.greatitalianfoodtrade.it/mercati/indicazioni-geografiche-75-miliardi-di-euro-in-ue-il-database-e-le-tutele-che-mancano

Marta Strinati, Dario Dongo. Pig market, serious anomalies on prices set by CUN. GIFT(Great Italian Food Trade). 13.2.21, https://www.greatitalianfoodtrade.it/mercati/mercato-suinicolo-gravi-anomalie-sui-prezzi-stabiliti-dalla-cun

(9) Dario Dongo, Marta Strinati. CUN pigs, the price is not (yet) right. GIFT(Great Italian Food Trade). 24.2.21, https://www.greatitalianfoodtrade.it/mercati/cun-suini-il-prezzo-non-è-ancora-giusto

(10) Dario Dongo, Andrea Adelmo Della Penna. Blockchain, the opportunities for the food and organic supply chain. GIFT(Great Italian Food Trade). 1.11.20, https://www.greatitalianfoodtrade.it/innovazione/blockchain-le-opportunità-per-la-filiera-agroalimentare-e-quella-biologica

Dario Dongo, lawyer and journalist, PhD in international food law, founder of WIISE (FARE - GIFT - Food Times) and Égalité.